When it comes to safeguarding your family’s future, a family trust is one of the most powerful and effective tools available. Many people mistakenly believe that trusts are only for the wealthy, but the truth is, anyone who wants to protect their assets and ensure a smooth transfer of wealth to future generations can benefit from setting up a family trust.

A family trust can help protect your hard-earned wealth from creditors, ensure tax efficiency, and give you peace of mind knowing that your loved ones will be well taken care of. And while the idea of a trust may seem complex, the process is more straightforward than it sounds.

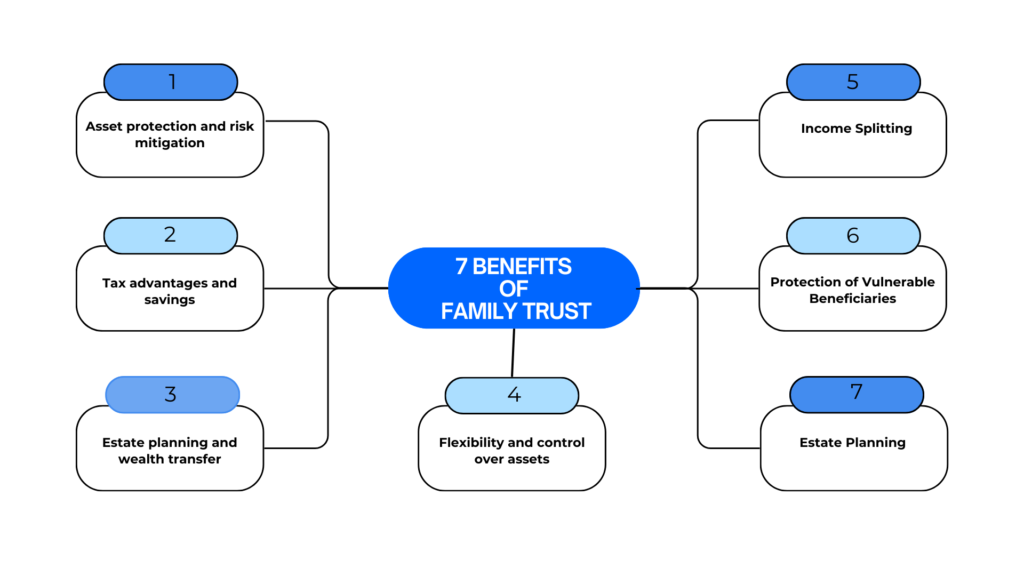

In this article, we’ll walk you through the top 7 benefits of a family trust and show you why it’s an excellent choice for protecting your family’s financial future.

What is a Family Trust?

A family trust, often referred to as a discretionary trust, is a legal arrangement where one or more trustees hold and manage assets for the benefit of specific beneficiaries, typically family members. The trustee has the discretion to determine how and when to distribute the income or capital to the beneficiaries, providing a great deal of flexibility in managing family wealth.

How Does a Family Trust Work?

In a family trust, assets such as real estate, shares, or business interests are transferred to the trust, where the trustee manages them on behalf of the beneficiaries. The trust is governed by a trust deed, which outlines the trustee’s powers and responsibilities, as well as the rules for managing the trust and distributing assets.

7 Key Benefits of a Family Trust

1) Asset Protection

One of the biggest advantages of a family trust is the protection it offers for your assets. Assets held within the trust are legally owned by the trustee, meaning they are not vulnerable to claims from creditors or lawsuits against individual beneficiaries. This makes a family trust a great way to shield family wealth from unforeseen financial risks, including bankruptcy or divorce.

2) Tax Benefits

Family trusts offer significant tax planning opportunities. The trustee can distribute income to beneficiaries in lower tax brackets, helping to reduce the overall tax liability. This flexibility allows families to take advantage of lower tax rates among different members, effectively minimizing the total tax burden.

3) Estate Planning

A family trust is an excellent tool for estate planning. By holding assets in a trust, you can ensure that wealth is passed on to the next generation without having to go through the often lengthy and expensive probate process. Additionally, you can set conditions around how and when your beneficiaries will receive distributions, providing you with control over your legacy.

4) Flexibility in Distribution

With a family trust, the trustee has the discretion to decide how income and capital are distributed among the beneficiaries. This flexibility is especially beneficial if your family’s financial needs change over time. For instance, distributions can be made for education, healthcare, or other expenses, ensuring the trust adapts to the evolving needs of your family.

5) Income Splitting

Family trusts allow for income splitting, where the income generated by the trust’s assets can be distributed among beneficiaries. By allocating income to those in lower tax brackets, you can significantly reduce the amount of tax paid on the trust’s income, creating greater savings for the family as a whole.

6) Control Over Asset Management

By setting up a family trust, you retain control over how your assets are managed and distributed. The trustee has a fiduciary duty to act in the best interests of the beneficiaries, and you can appoint or remove trustees as necessary to ensure that your wishes are carried out effectively.

7) Protection for Vulnerable Beneficiaries

A family trust can be tailored to protect vulnerable beneficiaries, such as young children, those with disabilities, or individuals who may not be financially responsible. This ensures that their financial future is secure while protecting the trust assets from being misused or mismanaged.

Setting Up a Family Trust

Setting up a family trust in Australia is a relatively straightforward process but does require careful planning. Here are the key steps involved:

1) Choosing a Trustee

The trustee can be a trusted family member or a corporate trustee. It’s crucial to choose someone responsible and capable of managing the trust’s assets effectively. Corporate trustees can offer continuity and professional management.

2) Drafting a Trust Deed

The trust deed is the legal document that outlines the terms and conditions of the trust, including the powers of the trustee, the appointor (who can remove or appoint trustees), and the rights of the beneficiaries. This deed must be tailored to your family’s unique needs and goals.

3) Transferring Assets

To activate the trust, you will need to transfer assets such as real estate, shares, or cash into the trust. This process may have tax implications, so it’s important to get professional advice.

4) Tax Considerations

A family trust offers tax advantages, but it’s important to be aware of the specific tax rules that apply. For example, a family trust election may need to be lodged with the ATO to access certain tax concessions.

Conclusion

Establishing a family trust can be one of the most effective ways to protect your assets, minimise tax liabilities, and ensure the financial security of your loved ones. With the right planning, a family trust offers flexibility, control, and peace of mind, knowing that your wealth is safeguarded for future generations.

Take control of your family’s financial future today!

At BOA & Co. Chartered Accountants, we understand the importance of protecting your family’s financial future. Our expert team is here to help you navigate the complexities of setting up a family trust, ensuring that your assets are safeguarded for generations to come. Whether you’re just starting to consider a trust or need assistance managing an existing one, we’re ready to provide you with the professional guidance you need.

Contact BOA & Co. Chartered Accountants today at 1300 952 286 or email us at [email protected] for personalized advice on setting up a family trust. You can also visit us at www.boanco.com.au to learn more about how we can help you secure your family’s future.